Little Known Questions About What Is Trade Credit Insurance.

Wiki Article

9 Easy Facts About What Is Trade Credit Insurance Described

Table of Contents5 Easy Facts About What Is Trade Credit Insurance ExplainedWhat Does What Is Trade Credit Insurance Do?What Is Trade Credit Insurance Fundamentals ExplainedWhat Is Trade Credit Insurance Fundamentals ExplainedWhat Is Trade Credit Insurance - Truths

Trade credit report insurance policy (TCI) reimburses companies when their consumers are incapable to pay due to bankruptcy or destabilizing political problems. Insurance providers commonly price their plans based upon the size and number of customers covered under the policy, their credit reliability, as well as the risk integral to the industry in which they run.Right here are 3 other possible techniques. One choice is to self-insure, which implies the company develops its very own book fund especially designed to cover losses from overdue accounts. The drawback to this approach is that a business might need to reserve a significant amount of resources for loss avoidance as opposed to making use of that cash to expand business.

Nevertheless, a variable generally buys the right to those receivables at a substantial discountusually 70% to 90% of the invoiced quantity. The financial institution may get a larger percentage if the aspect manages to collect the full debt, yet it still has to pay a significant fee for the aspect's solutions.

Essentially, it's a guarantee from the buying business's bank that the seller will certainly be paid in full by a certain day. Among the downsides is that these can only be gotten and also spent for by the purchaser, which may be hesitant to pay the purchase charge quantity for the bank's assurance.

What Is Trade Credit Insurance for Beginners

That stands for a compounded annual development rate of 8. 6%.

Rise in sales as well as profits A credit history insurance plan can normally offset its very own expense often times over, also if the insurance policy holder never makes an insurance claim, by enhancing a business's sales as well as earnings without extra threat. Enhanced loan provider connection Profession credit score insurance coverage can enhance a business's relationship with their loan provider.

With profession credit score insurance, you can accurately manage the industrial and also political risks of trade that are beyond your control. Trade credit history insurance coverage can help you feel safe and secure in extending extra debt to present clients or seeking new, larger customers that would have otherwise appeared also dangerous. There are 4 types of trade credit score insurance policy, as described below.

The Only Guide to What Is Trade Credit Insurance

Whole Turnover This type of profession debt insurance coverage secures against non-payment of commercial financial obligation from all clients. You can select if this protection puts on all residential sales, international sales or both. Key Accounts her explanation With this kind of insurance, you pick to guarantee your biggest consumers whose non-payment would certainly position the best threat to your service.Transactional This form of profession debt insurance coverage protects versus non-payment on a transaction-by-transaction basis and is finest for firms with couple of sales or only one client. Outstanding financial debts are not covered unless there is direct profession between your organization and also a customer (one more organization).

It is usually not one of the most effective service, due to the fact that as opposed to spending excess resources right into growth opportunities, a company must place it on hold in instance of uncollectable loan. A letter of debt is another option, however it just gives debt protection for one customer as well as only covers worldwide profession.

The factor supplies a cash advance ranging from 70% to 90% of the billing's worth. Some factoring services will assume the risk of non-payment of the billings they acquire, while others do not.

Unknown Facts About What Is Trade Credit Insurance

Nevertheless, while receivables factoring can be useful in the short-term, you will have to pay costs ranging from 1% to over here 5% for the solution, even if the receivable is paid in complete within 60-90 days. The longer the receivable continues to be unsettled, the greater the fees. Settlement assurances aren't constantly offered, as well as if they are, they can double factoring costs to as high as 10%.The financial institution or element will provide the financing and also the debt insurance coverage will secure the billings. In this situation, when a financed billing goes unsettled, the case payment will certainly most likely to the funder.

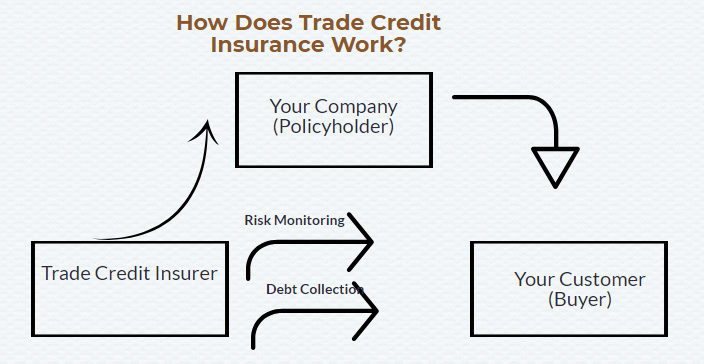

Credit report insurance policy protects your money flow. Trade debt insurance coverage works by guaranteeing you versus your buyer falling short to pay, so every invoice with that customer is covered for the insurance year.

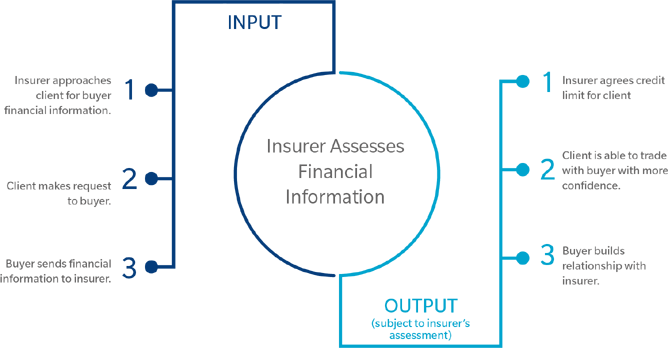

At Atradius Australia, we run a Modula Credit score Insurance Policy Plan. Atradius Credit report Insurance coverage explained: Your credit scores insurance company ought to visit the website monitor the economic health and wellness of your consumers and also potential consumers as well as apply a danger rating, usually called a purchaser rating.

The 7-Minute Rule for What Is Trade Credit Insurance

It will certainly lead exactly how much of your direct exposure they are prepared to guarantee. The buyer score is additionally a helpful device for you. You can use it as an overview to sustain your own due diligence as well as assist you avoid potentially dangerous clients. A solid customer rating can also assist you protect possible buyers by using them good credit scores terms.

Report this wiki page